Saudi Employment Overview

The Saudi Labour Regulations

Saudi Arabia’s labour laws have their foundation in Royal Decree No. M/51, dated 23/8/1426 H, corresponding to 27/9/2005 G (as amended) – “the Labour Law,” and its Implementing Regulations enacted by Ministerial Resolution No. 1982 dated 28/6/1437 H corresponding to 6/4/2016 G – “the 2016 IRs”. These are together interpreted in conjunction with shariah law’s requirements and provisions.

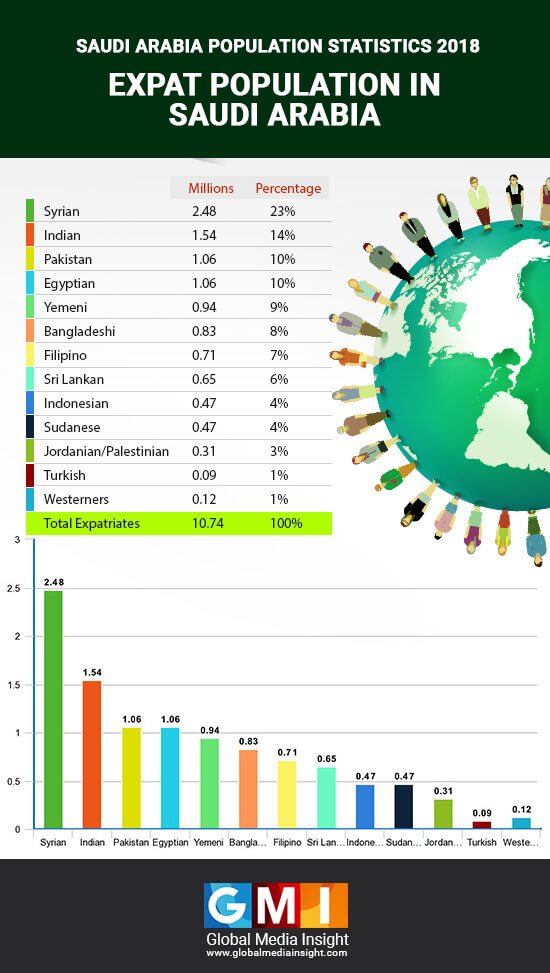

Expat Workers and Saudisation

The current population of Saudi Arabia is around 34 million in 2019 with the expatriate makeup around 10 million of that or 30%. Around 2011, due to the relatively high unemployment levels of Saudi citizens gaining focus at the time, some 40% of under 25s being unemployed, increased efforts were set out to lower the proportion of the expatriate workforce to nearer 20% through the process of Saudisation. Under the National Transformation Plan unemployment among Saudi citizens is targeted to be reduced to 9% by 2020.

With the economy recently facing renewed headwinds, lower oil prices and reassessments of government spending, 2017 and 2018 saw a particularly strong drive to ensure private companies were complying with those earlier Saudisation initiatives alongside 100% Saudisation being enforced in new sectors.

Source: Global Media Insight – Dubai

Web Design Company

Saudisation Requirements

Any new company establishing in Saudi must lay out their plans to recruit and train Saudi nationals in their submissions to the Saudi Arabian General Investment Authority. Furthermore internal policies and procedures are to be detailed on how non-Saudi roles will be converted to Saudi positions and over what time frame under Article 16 of the 2016 implementing regulations. Numerous specific jobs types may no longer be held by non-Saudis with a recently expanding list in sectors such as retail.

The work week in the Saudi private sector tends to be 6 days (48 hrs) with Friday being the only paid day of rest. Public sector workers however take a 2 day weekend on Friday and Saturday. The Saudisation initiatives to get Saudis into private sector jobs as opposed to public sector ones is somewhat hindered by locals not wishing to give up the 2 day weekend they have in the public sector. Two thirds of Saudis are employed in the public sector. Of the private sector job titles reserved for Saudi nationals, the government is considering formally making these 5 day work week (40hr) positions rather than 48 hr jobs so as to offer an official 2 day weekend. More generally working hours can be extended beyond these definitions but only within the limits of the provisions of Article 106 and Article 101 of the Labour Law.

Nitaqat is one of the Saudisation tools which allocates companies platinum, green, yellow or red classifications depending on the number of employees, size of the company and occasionally the company’s activity. These colour codes relate to the level of Saudisation required and any non-compliance with the requirements can make it hard for a company to continue operations. Sanctions include fines, restrictions on new employee visas, license renewals, residency permits, employee transfers and alike.

It is worth noting that Saudi nationals employed for the purpose of meeting Nitaqat quotas are required to be paid a minimum wage of 3,000 SAR in order to be counted and since 2018, nationals over 60 years old will no longer be counted towards the quota.

Previously, inspections on companies to ensure Saudisation initiatives were being complied with, were carried out by the Ministry of Labour’s own officials but in 2018 the monitoring was outsourced to private inspection companies in order to increase effectiveness.

Expat Employment

Article 33 stipulates requirements for issuing foreign worker permits in that they must have entered the country legally, posses education and professional qualifications that the country needs and nationals do not possess and that the employer takes responsibility for them under a formal valid employment contract.

Iqama is the work permit rules system for non-Saudis which lists an employee’s sponsor and profession. Working in an unrelated job to the Iqama is generally not allowed under the Labour Law. It used to be possible to amend these permits with changes to the job title relatively easily but in 2018 this service was stopped by the Ministry of Labour in an effort to help further reduce the expatriate labour force and increase Saudi hires.

Non-Saudis are not permitted to work for anyone other than their sponsor unless excepted under the Ajeer system which is an online portal where such an arrangement is documented and fee paid for a permit to do so, (Article 14 implementing regulations 2016). These permits are generally valid for one month under the ‘free’ account or for up to 6 months if renewing on an ‘excellent’ account which incurs a 20 SAR monthly charge. Only workers in construction, operations and maintenance, cleaning and maintenance, consultancy and business services, institutes and colleges are permitted for Ajeer and the sponsor must be compliant with their current Saudisation requirements in order to participate.

The Ministry of Finance currently places fees on dependents of expatriate workers living in the Kingdom. 2018 has seen increasing numbers of families exiting as not only were these fees increased in 2017 but once again in 2018.

Recent Employer Obligations

Following on from the 2015 Ministerial Resolution No. 4786 issued on 28/12/1436H (corresponding to 12 October 2015) regarding fines and penalties for employers for non compliance, Ministerial Resolution dated 01/05/1439H (corresponding to 18 January 2018) clarified violations and brought some additional fines against employer abuses such as non timely payment of salaries.

The resolution works in favour of creating the workplace as being more accessible to women too. Female employment is becoming more attractive for families that used to rely on a single breadwinner to meet expenses and at the same time cultural perceptions of women in the workforce are altering. Targets are in place to have 30% of the workforce as female by 2030 up from a current 22%. As such failure to make the workplace suitable for them and to provide a female section for example, may now attract fines.

In May 2018 the Anti-Harassment Law under Royal Decree No. 488 dated 14/9/1439H corresponding to 29 May 2018G was issued and although not directly applicable to employers, some sections do specifically apply to them such as needing internal complaint mechanisms with confidentiality safeguards. Many see these steps as additional preparations for an increasing number of women joining the workplace in future.

Updated regulation regarding occupational safety also came about in 2018 where Minister of Labour and Social Development Resolution No. 161238, dated 10/8/1439 H, corresponding to 26/4/2018 G approved the Regulation of Occupational Safety and Health Management. This legislation requires companies to have written policies in the languages predominantly used by its workforce. By the summer of 2018 inspections were already underway by the Ministry of Labour and Social Development to ensure compliance in companies with more than 50 staff.

Employment Procedure

Employment contracts do not necessarily need to be in written form for nationals by law but only the employee is entitled to prove the existence of such an unwritten relationship using any means available. Either party may however demand a written contact at any time under Article 51 of the Labour Law. The implementing regulations of 2016 do provide a standard written contract to facilitate formal agreements being put in place. However the employment of non-nationals are required to always be written contracts as stated under Article 37 of the Labour Law.

Limited term and unlimited term contracts are available to Saudi nationals, whereas only limited term contracts are applicable to non-Saudi employees. If a fixed term is not mentioned in a worker’s contract then it will align with the validity of the work permit according to Article 37.

When issuing an employment contract it is recommended to include certain things for clarity. These would include a probation period, salary amount paid in SAR, acknowledgement of Article 98‘s provision of a maximum of 8hrs a day work and 6 hrs during Ramadan. The 21 days of leave allocated which increases to 30 after 5 years Article 109 and how that excludes national holidays and sick days (implementing regulations 2016 Article 25). It should also note which national holidays are provided for as fully paid Article 112 (Article 25 implementing regulations) being 4 days Eid al Fitr, 4 for Eid al Adha and 1 for National Day. It should also specify the sick leave allowances under Article 117 being 30 days at full pay, 60 days at 75% pay, plus another 30 thereafter without pay for any substantiated sick leave.

Other things one might consider placing in a work contract are the basic rules of shariah which foreigners may need to be enlightened about such as the consumption of alcohol or pork, awareness of the Anti Bribery provisions in Royal Decree No. M/36, dated 29/12/1412 H, corresponding to 1/7/1992 G as well as being made aware of the long arm reach of foreign anti bribery laws such as the US FCPA and UK’s Bribery Act. Any anti money laundering requirements would need to comply with the local legislation Anti-Money Laundering Law enacted by Royal Decree No. M/20 dated 05/02/1439H (25/10/2017G).

Employees can not be terminated without valid reason regardless of their contract type, although no guidance exists as to what defines the scope of valid reason beyond those found in Article 80. Redundancies or ceasing operations (Article 74.6) have generally been deemed to be valid reasons. Workers can be let go with non renewal of a fixed term contract or conversion to an unlimited term contract which then allows 60 days notice (for employees paid monthly, 30 days for more frequent payments) for a valid reason.

As already mentioned if the employee is a foreigner, the Labour law states that the expiry of the work permit counts as an end date of the contract if none is defined in the contract anyway (Article 37), so true unlimited term contracts in practice only tend to exist for nationals. At the end of employment settlement must be made in accordance with the time frames in Article 88 and if the worker is non-Saudi the employer must bear the cost of their flight home (Article 40.1) unless they resigned without a valid reason (Article 40.2).

The contract may be wise to include the calculations for end of service gratuity due under the various scenarios found in Articles 84, 85 & 87 and the forfeit of such a reward if the employee is dismissed for conduct found in Article 80. If in doubt the free end of service report generator at Saudi Hires can very helpful.

The contract should be in place before work begins and any changes to it should be mutually agreed in writing which then revokes any earlier agreement.

Probation

In terms of probation, it is allowed for a 90 day period which can then be subsequently extended to 180 days if agreed by both parties in writing. Any termination by either party during this period does not require a notice period. The 2016 implementing regulations Article 20 specify the 180 allowance must consist of 2 90 day periods agreed to separately, the 180 days can not be written into the contract at the start.

Health Insurance

Health insurance must be provided to employees based in Saudi Article 144.

Non Compete Agreements

Non compete clauses are allowed under Article 83.1, they must be in writing, for less than 2 years and clearly define the prohibited work with competitors.

Payment of Wages

The Saudi wage protection system requires wages to be paid via an accredited bank within Saudi (Article 90.2) and by the end of 2018 is applied to all firms with more than 10 employees.

Overtime

Overtime work must be paid for in accordance with Article 107 (in light of Articles 106 & 101) at the rate of their regular wage plus 50% with a limit of 720 over time hours a year according the implementing regulation Article 23.

Social Security Taxes

For every foreign worker employed the company must pay a tax of 2% equivalent of the workers salary to the Occupational Hazards Branch of the General Organisation for Social Insurance, this is from the company’s funds and not deducted from the worker.

For every Saudi employee the company must pay 9% of their equivalent salary Annuities Branch of the General Organisation for Social Insurance and another 1% for the unemployment insurance scheme called Saned organised under the General Organisation for Social Insurance.

Workplace Regulations

The internal policies for companies have a standard template issued in the 2016 implementing regulations. Under Article 4 of those, the employer must log into the portal of the Ministry of Labour to accept the standard template or add additional items. Those would then be reviewed for compatibility with existing regulations. These policy rules then need to be displayed in an obvious location in accordance with Article 13 of the Labour Law. The standard rules also specify penalties and procedures for 49 particular acts by the employee and differ dependent on how many times the employee commits the violation.

Finally all records and contracts should be translated into Arabic. Arabic is the language such documents will be analysed in should litigation occur.

Where labour disputes occur mediation is conducted by the Labour Office as a mandatory first step. If the non-binding decision arising from that process is disputed by either the employee or employer, then the case is escalated to the Commission for the Settlement of Labour Disputes.

Disclaimer: Although this article was collated by a qualified (LLM) international law specialist, nothing in this article should be deemed to be, nor relied upon, as legal advice. SaudiHires.com, its owners and operators do not guarantee the accuracy of any interpretations herein or anywhere on its website, nor warrant that links will always point to the most up to date regulations or accurate translations. Always seek professional and licensed legal advice in your jurisdiction.